Is Exness Regulated? A Comprehensive Overview

In the world of online trading, the security of your investments is paramount. One of the biggest concerns for traders is whether their chosen broker is regulated by a competent authority. This brings us to the question, is Exness regulated? Let’s delve into this topic and examine the regulatory landscape surrounding Exness, its licensing, and what it means for traders. Additionally, we’ll highlight how having a regulated broker enhances your trading experience and safety. For more information on Exness, you can visit is exness regulated trading-vietnam.com.

Understanding Regulation in Forex Trading

Forex trading is a decentralized market, where currencies are traded in real-time, and it spans across the globe. Due to its vast nature, regulation is crucial in ensuring that brokers operate within defined legal frameworks. Regulatory bodies exist to protect investors, ensuring that brokers adhere to the highest standards of conduct, transparency, and accountability.

Exness Overview

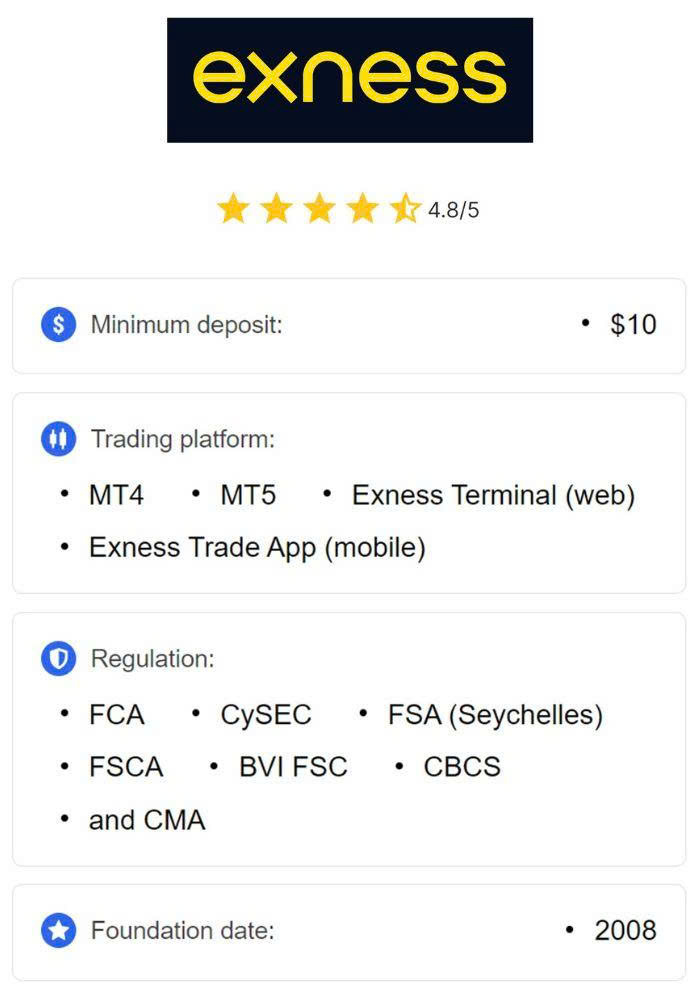

Founded in 2008, Exness has quickly evolved into one of the leading forex and cryptocurrency brokers. They offer a wide array of financial instruments, competitive spreads, and various account types suitable for both beginner and experienced traders. The broker’s commitment to providing a transparent and secure trading environment is evident in its operational ethos.

Is Exness Regulated?

Yes, Exness is regulated by several reputable authorities. The broker holds licenses from the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) of South Africa. These licenses signify that Exness is subject to stringent rules governing its operations, client funds, and service delivery.

CySEC Regulation

The Cyprus Securities and Exchange Commission (CySEC) is one of the most renowned regulatory bodies in Europe. By being regulated by CySEC, Exness must comply with various directives that protect traders, including the implementation of a negative balance protection policy, ensuring that clients cannot lose more money than they have in their accounts.

FSCA Regulation

The Financial Sector Conduct Authority (FSCA) in South Africa is another key regulatory body that oversees financial institutions, ensuring that they maintain fair and transparent practices. Exness’s regulation by the FSCA adds a layer of credibility, especially for traders in Africa.

The Importance of Regulation

Regulation is crucial for several reasons:

- Investor Protection: Regulatory bodies enforce rules that protect the interests of traders. For instance, clients’ funds are often kept in segregated accounts, separate from the broker’s operating capital.

- Transparency: Regulated brokers must provide clear information regarding their operations, fees, and trading processes, which helps build trust among clients.

- Complaint Resolution: Traders have avenues for formal recourse if they encounter issues with their broker, ensuring that grievances can be addressed professionally.

Trading with a Regulated Broker vs. an Unregulated Broker

Choosing between a regulated and an unregulated broker can significantly impact your trading experience. Here’s how they stack up:

Regulated Brokers

- Adhere to strict financial regulations.

- Offer security for client funds through segregation and compensation schemes.

- Must conduct audits and maintain a certain level of financial transparency.

- Provide better recourse options for dispute resolution.

Unregulated Brokers

- Lack accountability to any regulatory authority.

- Client funds may be exposed to higher risks.

- May not be transparent about fees and spreads.

- Dispute resolution mechanisms may be non-existent or ineffective.

Exness Trading Features

Being a regulated broker, Exness offers numerous features that enhance user experiences:

- Multiple Account Types: Traders can choose from various account types based on their trading style and preferences.

- Low Spreads: Competitive spreads make it cost-effective for traders to execute their strategies.

- Leverage Options: Exness provides flexible leverage options, which can amplify potential returns (but also risk).

Final Thoughts

In conclusion, the question of is Exness regulated? can be confidently answered with a resounding yes. Being regulated by reputable authorities such as CySEC and FSCA places Exness in a good position within the online trading landscape. Regulation offers traders a layer of protection and confidence not available with unregulated brokers. For anyone considering trading with Exness, the assurance of regulation presents a strong case in favor of choosing this broker for your trading needs.